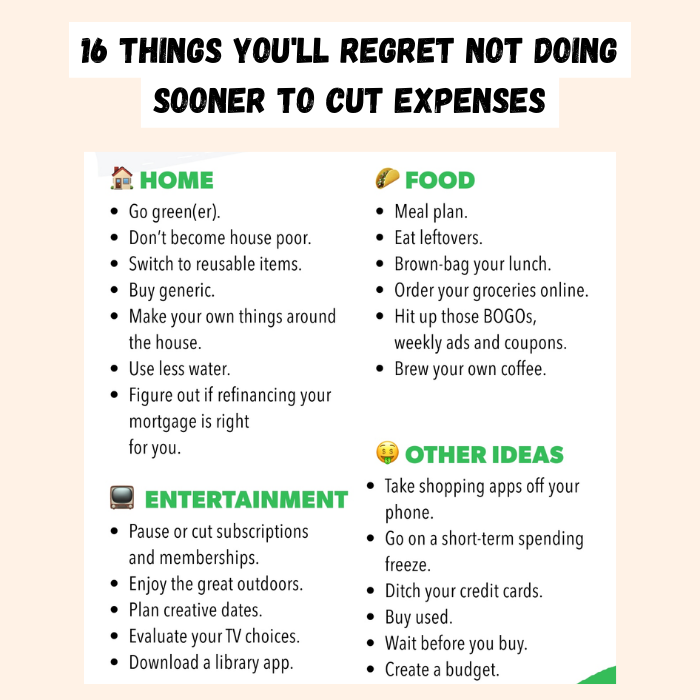

16 Things You’ll Regret Not Doing Sooner To Cut Expenses

Are you tired of constantly feeling the pinch in your wallet? Do you wish you could finally take control of your finances and start saving money? Well, we’ve got some incredible news for you! In this blog post, we’re going to reveal 16 game-changing strategies that will help you slash your expenses like never before.

From simple everyday habits to clever long-term investments, these nuggets of wisdom are guaranteed to leave you wondering why on earth you didn’t discover them sooner. So get ready to bid farewell to financial stress and say hello to a brighter future filled with smart choices and extra cash in your pocket.

Table of Contents

16 Things You’ll Regret Not Doing Sooner To Cut Expenses

There are a few expenses you’ll regret not cutting sooner. Here are five of them:

- Cable TV: Americans spend an average of $103 a month on cable TV, more than any other type of subscription service. That’s more than we spend on food or housing Cut the cord and save money every month.

- Cell phone plan: Most people have two cell phones one for work and one for personal use. But if you only need one phone, get a prepaid plan instead of a contract plan with your carrier. You can save hundreds of dollars a year by switching to a prepaid plan.

- Rent or lease a car: If you can, try to rent or lease a car rather than buy one. Not only will you avoid buying an expensive car, but you’ll also avoid the high monthly payments that come with owning a car. You can also find great deals on cars when you lease or rent them, so be sure to check out the rental market before making your decision.

- Skip the gym membership: Don’t pay for it if you don’t need it! There are plenty of accessible and affordable fitness options available in most towns, including gyms in public libraries and parks. And if you need exercise, try walking or biking instead of driving to the gym.

- Don’t eat out as much as you used to: If dinner at home is just too costly for your budget, try making some meals at home instead of going out to eat. You can save a lot of money by cooking your meals from scratch instead of eating out.

- Cut back on your spending on clothes: It’s easy to spend money on clothes every month, but try to limit yourself to one or two pairs of jeans and one or two shirts. And don’t forget about accessories such as shoes and purses.

- Skip the car washes: Sometimes it’s easier to just clean our cars ourselves using a bucket and a sponge rather than go to the car wash. Plus, car washes can be expensive especially if you use them more than once a month.

- Don’t overspend on vacation: If you’re planning a vacation this year, don’t overspend on things like airfare, hotel rooms, and rental cars. Instead, try to save money by staying in a lower-cost area or doing something like cooking your meals while you’re on your trip.

- Cut back on your entertainment expenses: TV channels, movies, and concerts can all be expensive, so limit your entertainment spending to once or twice a month instead of every week.

- Switch to a cheaper gas station: If you’re driving a lot, it can be worth it to switch to a cheaper gas station that charges lower fuel prices. Not only will you save money on your gas bill, but you’ll also avoid the high cost of parking at a regular gas station.

- Don’t overspend on groceries: It’s easy to go overboard when shopping for groceries, but try to stick to a budget and buy only what you need. You’ll save money and won’t have any food left over that you have to throw away.

- Cut back on your entertainment expenses: TV channels, movies, and concerts can all be expensive, so try to limit your entertainment spending to once or twice a month instead of every week.

- Use public transportation instead of driving: If you don’t have a car, public transportation is the best way to get around town. And if you do have a car, consider using it only for essential trips like going to work or visiting family.

- Consider joining a gym membership: Gyms are usually free or inexpensively priced, and they offer lots of different types of classes and workouts that you can use to stay fit.

- Shop at discount stores: Discount stores like Walmart and Target offer a variety of products at discounted prices, so it’s worth checking out their aisles every once in a while.

- Negotiate with your creditors: Sometimes it’s possible to negotiate with your creditors to get lower interest rates or more affordable payment plans.

What is the importance of budgeting?

Budgeting is not only important for individuals but also for businesses. When you have a budget, it allows you to stay organized and prevent overspending. When you can control your expenses, you can save money and reach your financial goals. There are several ways to budget: create a spending plan, create an expense spreadsheet, or use a Budget Wizard.

Each method has its advantages and disadvantages. Creating a spending plan is the easiest way to get started, but it may not be the most accurate. An expense spreadsheet is more accurate but can be more time-consuming to create. A Budget Wizard can help you create an effective budget in less time, but it may not be customizable enough for some people. Whatever method you choose, make sure that you regularly review and adjust your budget as necessary to stay on track.

How can you save money on your expenses?

One way to save money on your expenses is to make a budget and stick to it. If you can, try to cut unnecessary spending by researching the best deals and shopping for items when they’re on sale. You can also try using coupons or negotiating prices with merchants. Consider recycling and reducing your waste. All of these tips can help you save money without feeling deprived.

How do you cut down on your spending?

There are a few easy ways to cut down on your expenses.

- Set realistic budget goals: If you only have $10 to save each month, for example, don’t try to save $200 every month. Instead, set realistic monthly savings goals that will allow you to make progress and feel good about yourself.

- Think about what you need and don’t need: Sometimes we overspend because we think we need something when in reality we don’t need it or can afford something else better. Ask yourself: do I need this? Can I live without it? If the answer is no, then maybe it’s time to let go of that purchase.

- Get rid of unnecessary items in your life: This might mean selling items online or at a garage sale, donating items to charity, or throwing away an old item that you no longer use or use regularly but doesn’t fit into your style anymore. By getting rid of unnecessary items, you’ll free up more money to spend on things that are important to you.

- Cut back on luxuries and unnecessary expenses: Some common luxury expenses include eating out often, buying clothes that are too expensive, and spending money on unnecessary house repairs or renovations. When trying to curb expenses, be sure to assess all of your spending habits and make necessary cuts where necessary so that you still enjoy the same level of living while saving money.

What are some tips for saving money on groceries?

When it comes to saving money on groceries, there are a few things you can do to help save some extra cash. Here are a few tips:

- Plan Your Meals Ahead: One way to save money on groceries is to plan your meals ahead of time. This will help you avoid buying unnecessary items, and it will also make mealtime more convenient since you won’t have to search for ingredients or cook them from scratch.

- Shop at Aldi and Other Discount Grocery Stores: Another way to save money on groceries is to shop at discount stores like Aldi. These stores often have lower prices on items than those found in regular grocery stores, and they also offer special deals on different types of food throughout the week.

- Meal Prep: Another way to save money on groceries is by preparing your own meals instead of eating out every day. This can be a great way to cut down on costs, and it also allows you more control over what you’re eating. Plus, if you’ve got some pre-made meals waiting in the fridge, all you have to do is heat them up.

- Get Coupons: One of the best ways to save money on groceries is by getting coupons. Not only will this allow you to save significantly on specific brands or types of food, but it can also lead to discounts on larger purchases (like an entire cartful of groceries).

- Negotiate Prices: If you’re able to negotiate prices with your grocery store clerk, you can often save even more money on your groceries. This is especially true if you know what items are typically cheaper in the store and how to ask for a discount.

How can you save money on transportation?

If you’re looking to save money on transportation, there are a few things you’ll regret not doing sooner:

First, take the time to research your options and find the best deal for what you need. There are many discount transportation agencies out there that can help you save money on your rentals or flights.

Second, keep an eye on sales and look for deals on tickets and rental cars. Try to avoid driving when possible and use public transportation or other forms of alternative transportation whenever possible. By taking these simple steps, you can easily save money on your transportation costs.

What are some tips for saving money on entertainment?

There are a few ways to save money on entertainment. Cut back on expenses by choosing cheaper options, watching free or pirated content, and using online streaming services:

- Cheaper Options: instead of going out to eat, cook at home and save money. Rent movies or watch them online for free using services like Netflix, Hulu, or Amazon Instant Video.

- Watching Free or Pirated Content: many movies and TV shows are available free or for a low cost through services like Crackle, Hulu, and Netflix.

- Using Online Streaming Services: many streaming services, like Netflix, Hulu, Amazon Prime Video, and HBO Now, offer a trial period for first-time users. This allows you to test out the service and see if it’s right for you before subscribing.

What are some tips for saving money on bills?

There are a few easy ways to save money on your bills. Follow these tips and you’ll be able to reduce your expenses each month:

- Check your bills for errors: Sometimes small mistakes can add up and result in large expenses. If there are any errors or mistakes on your bill, contact the company or organization that sent it to you and ask them to correct it. This will help you avoid overpaying for services or products.

- Consolidate your bills into one payment every month: If you have multiple bills coming in each month from different companies or organizations, try to consolidate them all into one payment so you’re only paying one bill per month instead of several smaller payments. This can save you a lot of money in the long run.

- Try using online bill-pay services: Many companies now offer online bill-pay services that allow you to pay your bills directly from your bank account without having to go through the mail or receive physical bills in the mail. This can save you a lot of time and hassle when it comes to paying your bills.

- Cut down on unnecessary spending habitually: One of the easiest ways to save money is by cutting back on unnecessary spending habits.” says Dave Ramsey, founder and CEO of Ramsey Financial Corporation. For example, if you regularly go out with friends for dinner but never cook anything at home, start cooking more at home so that you have something leftovers for lunch the next day instead of eating out every night.

- Consider using online savings accounts: Many banks now offer online savings accounts that allow you to easily save money for future expenses. This is a great way to hold onto money when you need it, and it can also help you build up a bit of a rainy day fund.

Conclusion

Cutting back on your expenses can be pretty daunting, but by following these 16 tips, you’ll be well on your way to slashing your spending in no time. From making better choices when grocery shopping to avoiding costly scams and pitfalls, these tips will help you save money wherever possible.

And who knows? You might just find that some of these recommendations are things that you’ve been doing without even realizing it! So get started today and see how much money you can save.