HSA vs FSA Which Is Better?

Welcome to the ultimate showdown: HSA vs FSA! In a world where healthcare costs continue to rise, these two powerful tools have emerged as superheroes for saving money on medical expenses. But which one reigns supreme? Join us as we dive deep into the battle between Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs), uncovering their unique features, benefits, and drawbacks.

Whether you’re an employee exploring your options or a curious individual seeking financial wisdom, this blog post will equip you with the knowledge needed to make an informed decision. So grab your cape and get ready for a thrilling ride through the fascinating realm of HSAs and FSAs – it’s time to find out which is truly better.

Table of Contents

What is an HSA?

Health Savings Accounts (HSAs) are a type of tax-advantaged savings account that allows you to save money in pre-tax dollars. This can help you pay for healthcare costs down the road without having to worry about getting hit with taxes.

An FSA, on the other hand, is an account that is specifically designed to help you save money for medical expenses. These accounts have lower contribution limits and often have higher earnings potential than HSAs. It’s important to choose the right one for you, so be sure to read up on each before opening an account.

What is an FSA?

An FSA is a type of savings account that allows individuals to save money tax-free. Both HSAs and FSAs are available through most banks and brokers, and both have the same features: you can contribute money whenever you want, and withdrawals are tax-free if used for qualified medical expenses.

The biggest difference between HSAs and FSAs is that HSA contributions are deposited into your own account, while FSA contributions are deposited into a separate account belonging to the employer. This is important because Contributions made to an FSA are considered taxable income when withdrawn.

The other main difference between HSAs and FSAs is that HSAs allow you to withdraw funds tax-free for qualifying medical expenses, while FSAs only allow tax-free withdrawal for qualified retirement expenses. However, many people use both HSAs and FSAS in combination, so it’s important to understand the differences before making a decision.

What are the benefits of having an HSA?

The health savings account (HSA) and flexible spending account (FSA) are two popular types of tax-advantaged accounts that allow people to save money for medical costs.

Here are the benefits of having an HSA:

- You can use your HSA funds to pay for out-of-pocket medical expenses, including doctor visits, prescriptions, and other medical costs.

- You don’t have to pay taxes on distributions from your HSA until you use them to pay for qualified medical expenses.

- If you have an FSA account, you can also use it to cover other related lifestyle costs, such as gym memberships and travel expenses.

- Your contributions will grow over time, without penalty, so you can accumulate more money for future medical needs.

- You can open an HSA even if you don’t have qualifying healthcare coverage through work or a government program like Medicare or Medicaid.

What are the benefits of having an FSA?

FSA stands for Flexible Spending Account. It is a tax-advantaged account that can help you save money on your medical expenses. Here are some of the benefits of having an FSA:

You can use your FSA to pay for qualifying healthcare expenses, such as:

- Doctor’s visits.

- Medical procedures.

- Prescription drugs.

- Hospital stays.

- Ambulance rides.

You can also use your FSA to cover uninsured medical costs. If you have an HSA, qualified healthcare expenses are tax deductible. Uninsured medical costs are not deductible.

If you lose your job or have a change in income, you may be able to use your FSA to cover current medical expenses until you can find another job or reach your new income level.

You cannot use an FSA to pay for nonqualified healthcare expenses, such as cosmetic surgery or fertility treatments.

Which is better: HSA vs FSA?

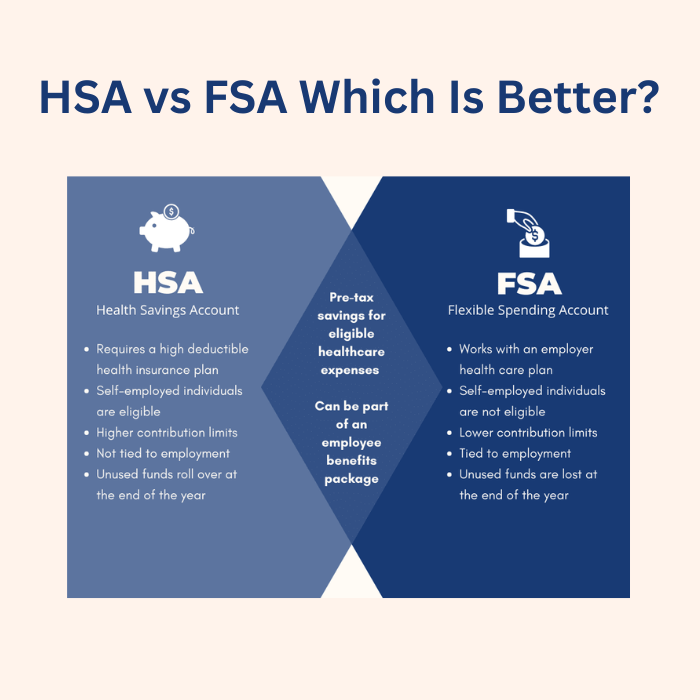

Health Savings Accounts (HSAs) and Flexible Spending Arrangements (FSA) both offer tax breaks for saving money on medical expenses, but which is better?

Both HSAs and FSA offer advantages and disadvantages. Here are the key points to consider:

- HSAs are more flexible than FSA. With an HSA, you can use the savings to cover a wide range of medical expenses, including premiums for health insurance plans, out-of-pocket costs for doctor visits and prescriptions, and even travel costs related to treatment. An FSA is less flexible and can only be used to cover certain types of medical expenses, such as premiums for health insurance plans or out-of-pocket costs for doctor visits.

- HSAs have higher contribution limits than FSA. You can contribute up to $3,500 per year to an HSA account, compared to $2,500 per year to a FSA account. This means that your contributions will be larger if you have high medical expenses.

- The interest earned on HSAs is exempt from federal income taxes. This benefit may be more important if you have a high income and are in the 25% or higher tax bracket. The interest earned on FSA accounts is subject to federal income taxes.

- Both HSAs and FSA offer significant tax breaks when used to cover medical expenses. Contributions made into an HSA account are deductible from your taxable income, while contributions made into an FSA account are not taxable until the money is used to pay for qualified medical expenses.

- HSAs and FSA offer different benefits for families. An HSA can be used by just one person in a family, while a FSA can be used by up to three people in a family. A family member who uses the FSA account to cover medical expenses can also count the contributions made by other family members toward their deductible limit. Ultimately, it is important to compare each type of account carefully before deciding which is best for you.

Pros and Cons of HSA vs FSA

HSA and FSA are two popular healthcare savings accounts available to Americans. Here’s a look at the pros and cons of each account:

HSA: Pros

- The HSA protects you from high out-of-pocket costs for medical care.

- You can use your HSA funds to pay for qualified medical expenses, including prescription drugs, doctor visits, hospital stays, and childbirth expenses.

- You can contribute up to $3,500 per year, per person, in addition to other qualifying contributions such as employer contributions or individual savings.

- Your money is tax deferred until you withdraw it for use in retirement or other purposes.

Cons

- You cannot use HSA funds to cover non-medical expenses such as vacations or car repairs.

- If you choose to roll over an HSA into an IRA or another healthcare savings account, the IRS may treat the account as taxable income.

FSA: Pros

- The FSA allows you to contribute up to $2,500 per year towards qualified medical expenses without worrying about taxation consequences.

- You can use your FSA funds for eligible medical expenses without having to worry about itemizing deductions on your tax return. This includes premiums for health insurance plans offered through your workplace, co-pays and deductibles associated with doctor visits and prescriptions, and other out-of-pocket medical costs.

Cons

- You cannot use FSA funds to cover nonmedical expenses such as vacations or car repairs.

- If you choose to roll over an FSA into an IRA or another healthcare savings account, the IRS may treat the account as taxable income.

On the whole, HSA and FSA are two great healthcare savings accounts that offer different benefits. Whichever account you choose, be sure to consult with a financial advisor to make sure you’re taking full advantage of what these accounts have to offer.

What is the difference between HSAs and FSA?

An HSA is a type of tax-advantaged savings account available to individuals in the U.S. A FSA is a type of cafeteria plan offered by some employers that allow employees to put pre-tax dollars into their own accounts to cover health care costs.

The main difference between HSAs and FSAs is that an HSA can only be used for healthcare expenses, while an FSA can also be used for other types of expenses, such as education costs or mortgage payments. Another key difference is that contributions made to an HSA are tax-deductible, while contributions made to an FSA are not tax-deductible.

Both HSAs and FSAs offer potential savings on healthcare costs, but they have different features that may be preferable for certain individuals.

Conclusion

If you are looking to save on your taxes this year, it is important to know the difference between an HSA and an FSA. Both have their benefits and both require some paperwork to set up, but ultimately they work in different ways. If you have health insurance through your employer that offers HSAs, then using them would be the best option for you.

An HSA allows you to contribute pre-tax dollars into a savings account that will grow tax-free until used. This could be a great way to save money each year on your tax bill. If you are self-employed or do not have health insurance through your job, then using an FSA would be a better option for you.

An FSA allows you to contribute funds from pretax income directly into your savings account. This means that the full amount of your contribution can go towards retirement savings goals without any additional taxes being due on the earnings inside of the account when it is withdrawn later on.