How To Calculate Living Expenses?

Are you tired of feeling overwhelmed and unsure when it comes to managing your finances? It’s time to take control and become a master at how to calculate living expenses. Whether you’re budgeting for the first time or looking to make some financial adjustments, this blog post is here to guide you through the process step by step.

Say goodbye to money-related stress and hello to a clear understanding of where your hard-earned cash goes each month. Get ready to unlock the secrets behind determining your living expenses like a pro.

Table of Contents

Items to Calculating Living Expenses

Assuming you’re not moving into your first apartment, you probably have a good idea of what your monthly living expenses are. But if you’re starting college or making a big career change, you might need to sit down and calculate your living expenses from scratch.

- To get started, Make a list of all of your necessary expenses, including:

- Rent or mortgage payments

- Utilities (electricity, water, trash)

- Transportation costs (car payment, gas, public transportation)

- Phone and internet bills

- Insurance payments (health, renters’, auto)

- Food costs

- Debt payments (student loans, credit cards)

- Entertainment and recreation expenses

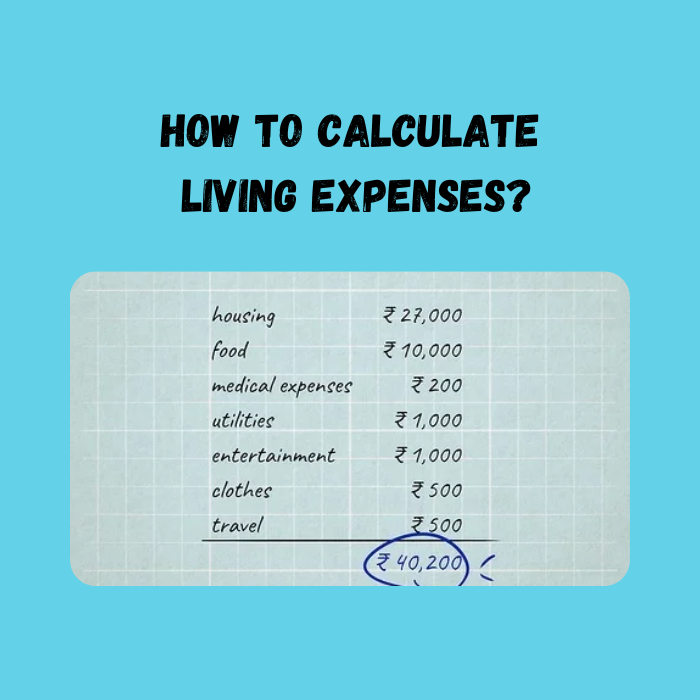

- Once you have your list, add up all of the monthly costs to get your total monthly living expenses. This is the amount of money you need to bring in each month to cover your basic needs.

Identifying Necessary Expenditures

The first step in calculating your living expenses is to identify all of the necessary expenditures that you will have each month. This includes fixed expenses like your mortgage or rent, car payment, and insurance as well as variable costs like groceries, utilities, and gas. Once you have a list of all of your necessary expenditures, you can begin to estimate how much each one will cost you per month.

Setting Up a Budget

Assuming that you don’t have a budget already in place, setting one up may seem like a daunting task. But it’s actually not as difficult as it seems, and it’s a very important step to take if you want to get your finances in order. Here’s a simple guide to setting up a budget:

- Determine your income. This is the first and most important step. You need to know how much money you have coming in every month before you can start allocating funds for living expenses.

- Figure out your fixed costs. These are the costs that stay the same each month, such as rent or mortgage payments, car payments, insurance premiums, etc.

- Track your variable costs. These are the costs that can fluctuate from month to month, such as groceries, gas, entertainment, etc. The best way to track these is by keeping receipts and categorizing them into categories like “transportation,” “food,” “utilities,” etc.

- Set aside money for savings and debt repayment. It’s important to make sure you’re putting some money away each month for financial goals.

Tracking Your Spending

If you’re not already tracking your spending, now is the time to start. Knowing where your money goes each month is an important step in taking control of your finances.

There are a number of different ways to track your spending. You can use a budgeting app like Mint or YNAB, or you can simply keep a spreadsheet of your income and expenses. Whichever method you choose, be sure to track both your regular monthly expenses as well as any one-time or irregular expenses.

Once you have a good handle on your spending, you can start to look for areas where you can cut back. Perhaps you’re spending too much on eating out or shopping for clothes. Or maybe you can save on your monthly bills by switching to a cheaper cell phone plan.

By tracking your spending and finding ways to reduce it, you’ll be well on your way to saving money each month.

Analyzing Your Financial Situation

If you’re like most people, you probably don’t have a clear idea of how much money you spend each month. This can make it difficult to create a budget or save money. The first step to take control of your finances is to analyze your spending habits.

There are a few different ways to do this. One option is to keep track of all of your spending for a month. This can be done by using a budgeting app, writing down everything you spend in a notebook, or creating a spreadsheet. At the end of the month, review your spending and see where you can cut back.

Another way to get an idea of your spending habits is to look at your bank statements and credit card bills. This can give you a good overview of where your money goes each month. You may be surprised to see how much you’re spending on things like eating out, entertainment, and shopping. Again, review your spending and see where you can cut back.

Once you have a good understanding of your spending habits, you can start working on creating a budget that works for you. If you need help getting started, there are plenty of resources available online and in personal finance books.

Managing Debt and Credit Cards

When it comes to managing your finances, one of the most important things to keep track of is your living expenses. This includes everything from your mortgage or rent payments to groceries and utilities. While some expenses are fixed, others can fluctuate month-to-month.

Calculating your living expenses can help you budget more effectively and make informed financial decisions. It can also help you identify areas where you may be able to cut back on spending.

To calculate your living expenses, start by adding up all of your fixed costs, such as your mortgage or rent payment, car payment, and insurance premiums. Next, add in your variable costs, such as food, gas, and entertainment. Don’t forget to account for periodic expenses like property taxes and home repairs.

Once you have a good understanding of your regular living expenses, you can begin to work on creating a budget. If you find that your expenses exceed your income, you may need to make some adjustments to ensure that you’re living within your means.

Saving Money for Emergencies and Investments

One of the most important steps in creating a budget is understanding your true living expenses. This includes not only your regular monthly expenses but also factors in one-time or occasional costs, as well as saving money for emergencies and investments.

To get started, make a list of all of your current monthly expenses. This should include things like rent or mortgage payments, utilities, groceries, transportation costs, and any other regular bills. Once you have a complete list, start adding up the totals to get an idea of your monthly spending.

Next, take a look at your one-time or occasional expenses. These are costs that you don’t necessarily have every month, but that you still need to account for in your budget. Examples might include car repairs, medical bills, or travel costs. Again, add up these items to get a sense of how much they add to your overall living expenses each year.

Don’t forget to factor in savings for both emergency funds and long-term goals like retirement. Even if you can only save a small amount each month, it’s important to have something set aside for unexpected costs or life changes. The same goes for investing – even if you’re just starting out, it’s important to begin building your nest egg now so that you can enjoy a comfortable future later on.

Optimizing Your Finances

Assuming that you are living paycheck to paycheck, here are a few tips to help optimize your finances:

- Make a budget and stick to it. This will help you track your spending and see where you can cut back.

- Build up an emergency fund. This will help you cover unexpected expenses without going into debt.

- Invest in yourself. Consider taking courses or investing in tools that will help you boost your income.

- Live below your means. Even if you are making more money, don’t spend all of it. Save for the future and enjoy life without putting yourself into debt.

Conclusion

To sum up, calculating your living expenses is an essential part of budgeting and managing your finances. If you’ve never done it before, the process can seem daunting – but with some careful research and planning it’s not as hard as you might think.

With a clear understanding of what you need to pay for each month, as well as how much money you have available to spend, living expenses calculations are key to maintaining a healthy financial situation.